Apple received a vote of market confidence from Raymond James on Monday when the brokerage firm raised its price target on the iPhone maker's shares from $250 to $280. Apple's stock price responded by hitting a new all-time-high above $240, up close to 2% and outpacing the U.S. market.

To hit the new Raymond James price target, Apple shares would need to gain another $40, or roughly 14% of the $280 target. Trading history in shares of the tech giant over the past two decades suggest that's possible.

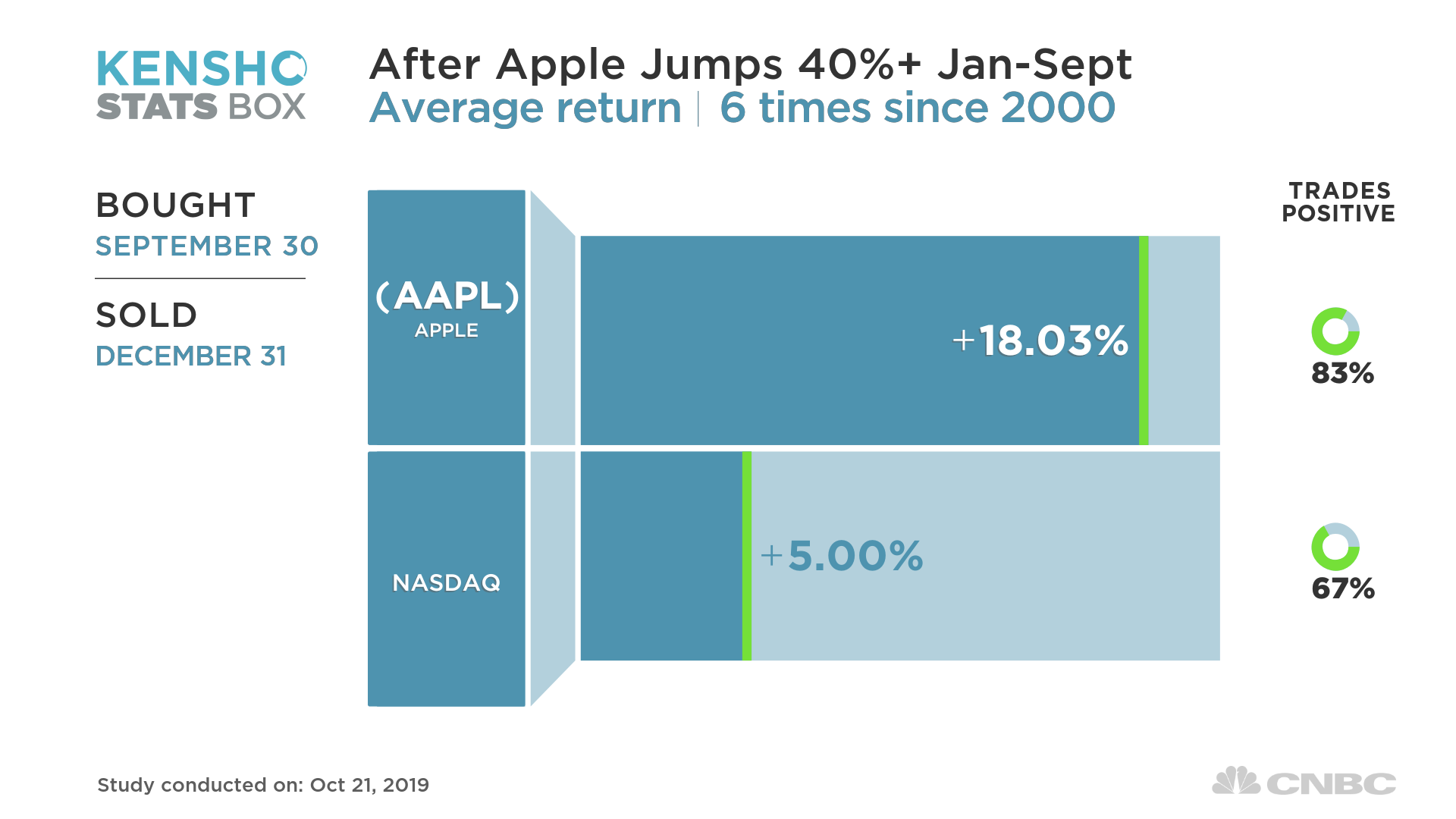

Over the first three quarters of 2019, shares of Apple jumped over 40%. Since 2000, the stock has had similar gains on six other occasions headed into the fourth quarter, according to hedge fund analytics tool Kensho, and the rally in Apple's shares often continued through the end of the year.

Apple shares gained an average of 18% across those historical trading periods, with the stock trading positively 83% of the time. The tech-heavy Nasdaq Composite was also consistently higher in these periods, adding 5% through the end of December, and trading positively 67% of the time.

While the introduction of the latest iPhone was not seen as an innovative leap, Apple CEO Tim Cook said initial sales were off to a "very strong start." The iPhone 11, iPhone 11 Pro and iPhone 11 Pro Max, hit store shelves Sept. 20. The phones feature upgraded cameras, batteries and processors, but, unlike some of Apple's competitors, they are not 5G-enabled.

Some market research indicates there's a sizable consumer segment that will hold out for 5G-enabled phones coming in the years ahead rather than go ahead and buy one of the new models.

Customers look at the Apple's new iPhone 11 series smartphones in an Apple retail store on East Nanjing Road in Shanghai.

Alex Ta | SOPA Images | LightRocket | Getty Images

J.P. Morgan recently raised its price target on Apple to $265 citing stronger-than-expected demand for the new phones and with the firm now forecasting Apple will sell 3 million more iPhone sales than expected in the final quarter of the calendar year.

Closely followed Apple analyst Ming-Chi Kuo of TF Securities recently wrote that the new and more affordable iPhone SE2 that will launch in the first quarter of next year for $399 could be a key to unlocking as many as 200 million upgrades from the iPhone 6 and 6s and a "key growth driver" for Apple next year.

An easing of trade tensions between the U.S. and China could also add to the rally in shares of the iPhone maker, whose business model has long relied on China as a core manufacturing base.

Reaed More

Post a Comment